22+ Self employed mortgage

To qualify for a BC. Conventional Loans for Self Employed Borrowers.

Real Estate Ads Real Estate Ads Home Buying How To Plan

Using FHA Loans For Self-Employed Borrowers on a home.

. Compare Rates of Interest Down Payment Needed in Seconds. Two or more years certified accounts. There is no mortgage insurance required.

A Director of a Partnership. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate. A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income.

Compare Offers Side by Side with LendingTree. Find your net income from Schedule C on your tax returns for the two most. Ad Were Americas 1 Online Lender.

Self-employed applicants must have at least two years of self-employment history or one year of self-employment and at least two years of employment in a similar role. Ad Realize Your Dream of Having Your Own Home. Get the Right Housing Loan for Your Needs.

If youve been self employed for a full year then you should be fine. A Director of a Company. The premise is based on monthly bank statements depositswithdrawals in determining what you are able to afford as a mortgage payment.

To prove your income when you apply for a self-employed mortgage you will need to provide. A 35 down payment. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Ad Compare Your Best Mortgage Loans View Rates. Recently Fannie Mae updated their. Compare Offers Side by Side with LendingTree.

Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. Comparisons Trusted by 45000000. Because you do not have an employer to.

Limits your choice of lenders though possibly. A FICO score of at least 580. Refi for self employed refinance self employed.

Scotia Mortgage for Self Employed Right for you if. Lock Your Rate Now With Quicken Loans. SA302 forms or a tax year overview from HMRC for.

One in five BC. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Maybe possible but probably.

ID such as a passport. The underwriting process is limited with. If the calculator says you.

To calculate your self-employment income for a mortgage application follow these simple steps. There are no loan limits on non-qm loans for self employed borrowers. A debt-to-income ratio below 50 percent.

Applying for a mortgage or understanding your options shouldnt be confusing yet there are just so many myths doing the rounds and its not easy to know where to turn to get. Down payment required is 5 to 20. View Ratings of the Best Mortgage Lenders.

Now is the Time to Take Action and Lock your Rate. Youre self-employed or in commission-based sales. Maximum LTVMinimum Down Payment.

Its possible to find an FHA lender willing to approve a loan. Being classed as self employed for lending purposes usually includes being. There has been an increase in the availability of conventional financing for self employed borrowers.

Self-employed mortgage borrowers generally need to have a minimum 10 down payment a good credit rating and proof of net income. In this blog we will discuss and cover using FHA loans for self-employed borrowers on a home purchase. Mortgage Refinance For Self Employed - If you are looking for lower monthly payments then we can provide you with a plan that works for you.

The easiest way to optimize your ratio is to shop on the lower end of what a mortgage calculator such as the one below says you can afford. Self Employed Mortgages Over the past 6 years working as a self-employed entrepreneurial mortgage broker Ive been surprised again and again by calls from potential. Ad 2022s Trusted Online Mortgage Reviews.

22 hr ago Approved Mortgage Geek. You want the ability to select any Scotiabank home ownership solution. To get approved youll need.

Get the Right Housing Loan for Your Needs. Apply for Your Mortgage Now. Ad Compare Your Best Mortgage Loans View Rates.

You can borrow up to a 95 loan-to-value LTV or make a down payment as low as 5 for the first 500000 and 10 for the remainder. As with any mortgage application youll need to provide some documents to the lender.

Bank Statement Mortgage Loans For Self Employed Borrowers How To Qualify The Borrowers Bank Statement Mortgage Loans

Kiyquofodqty M

Home Connolly Capital

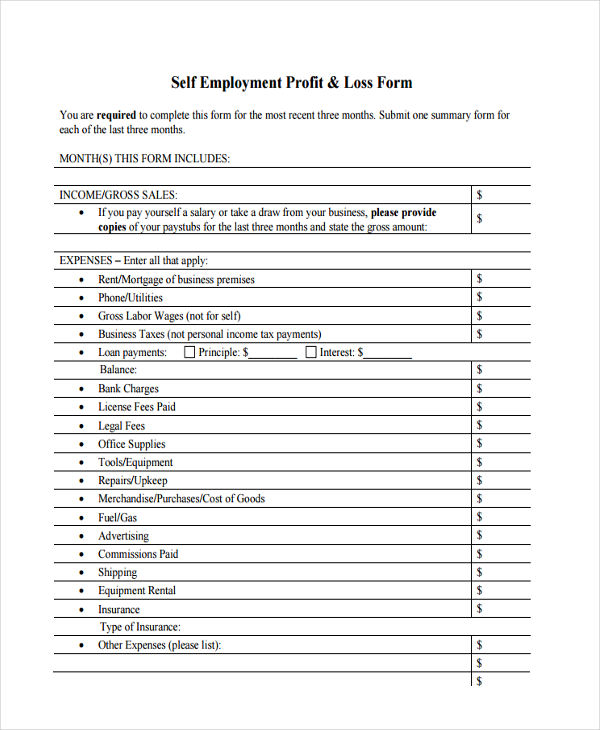

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf

Balance Sheet Template For Self Employed

Balance Sheet Template For Self Employed

How Will A 1 Year Gap In My Full Time Employment Affect My Ability To Get A Mortgage Quora

How Easy Is It To Get Approved For A Mortgage Quora

Home Connolly Capital

Balance Sheet Template For Self Employed

Self Employed Mortgage How Much Can I Borrow The Borrowers Self Mortgage

Home Connolly Capital

How Easy Is It To Get Approved For A Mortgage Quora

Home Connolly Capital

Christina Woolsey Transaction Coordinator Self Employed Linkedin

Balance Sheet Template For Self Employed

Mortgage Without Tax Returns Required Options For 2022 Dream Home Financing Mortgage Mortgage Tips Tax Return